After German toll increase: Decoupling of cost and rate development sparks concern

In December 2023, new toll fees came into force in Germany. This change prompted many discussions and negotiations about who should bear the burden. Now, at the end of February, after three months of application we can draw a preliminary assessment of how rates have evolved in comparison to the production costs of carriers.

Firstly, the results clearly indicate a significant decoupling of cost and rate evolution, particularly for markets touching Germany.

Germany domestic contracted FTL price and cost development

Source: Transporeon Market Insights, own illustration and analysis

In this analysis, we compared domestic contracted FTL rates (prices) to the underlying production costs of carriers. We used our total cost of ownership (TCO) model. Essentially, this TCO model simulates all the costs a carrier incurs to transport a full truck load on the road. These costs include driver wages, tolls, diesel, equipment costs, services, maintenance and more. We assess these costs quarterly and observe changes over time. Within the cost calculation we also cover empty mileages and the cost burden to find a connection or back load beside the pure loaded transport.

Of course, cost development does not directly translate into rate developments because market factors also influence rates. However, in the long run, cost evolution defines the path of contract rate development. Factors preventing an uniform development of rates and costs include the ratio of demand and supply, carriers’ efficiency increases and the resulting changes in carrier's margins.

The graph above reveals a concerning situation, as rates have not yet fully followed the cost development. Of course, there is always the issue to which extent efficiency increase can mitigate increases in the overall cost base. But a gap of 5.3% as visible in this analysis can’t be explained with this. Currently, low demand for transportation appears to be the dominating mitigation factor. This leads to drastically decreasing margins or even losses for carriers at current contracted rate levels, if nothing changes. This situation is unsustainable in the long term. So the potential for contracted rate increases is rising again on the horizon in Germany. In this context, the question is not if, it's when rate increases will hit the market to close the gap to cost levels.

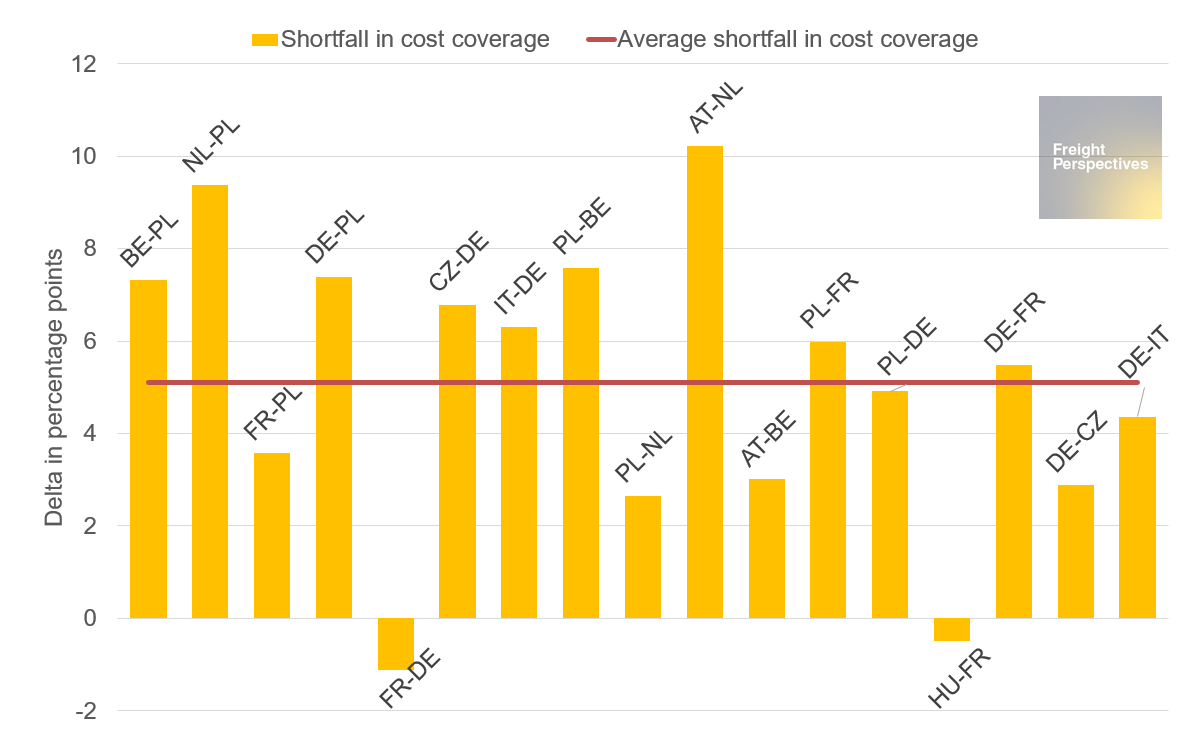

Overview of shortfall in cost coverages across international corridors

Source: Transporeon Market Insights, own illustration and analysis

The values above represent the percentage point difference between costs and rates development from September 2023 to February 2024. For instance, our simulation shows cost increases from Belgium to Poland. In a second step, we subtracted the contracted rate change for the same period, resulting in a 7.5 percentage point deficit in cost coverage compared to the rate level. On the other side, negative values represent corridors with higher rate increases than cost increases. On average, we see for these international corridors the same situation as for domestic Germany, namely a shortage of rate increases of 5.1 percentage points.

Does this suggest we will soon see a corresponding increase in rates?

Not necessarily, as market factors and efficiency increases can also have an impact. Additionally, in reality, costs on the carrier side do not increase quarterly or in waves as they do in our model. Due to these limitations, it is likely that the identified rate deficit represents the maximum possible gap. Therefore, it suggests that there is flexibility in both the magnitude and timing of the next increase in contracted rates.

Many of you might wonder: “When is the best time for my next tender or rate negotiation?”

Well, current contracted rates might not fully reflect the new situation. Some players may have agreed that new toll fees or cost levels will be covered with rates coming into force in March or April, indicating a possible timing discrepancy. Another explanation could be that while toll increases have been approved by shippers, other factors like wage increases and inflation have not. Given the current demand and supply situation, this is a likely scenario.

To answer this question, if the situation matches the analysis, then the best time for tender and/or negotiation is now, especially if it's necessary. As we expect costs and demand to rise throughout the year, the identified mitigating factors will become less.

Alternatively, if negotiation or tendering isn't required, maintaining current levels could be a strategic move. However, with increasing pressure, timing is crucial to secure new rates and capacity before an economic boom or a general decrease in available capacity arises. The latter appears to be the more realistic scenario at present.

From a carrier perspective, it would be an option to have standardized adjustment processes in place, ideally embedded in the contracts. This ensures that if a specific cost component, like tolls for example, increases significantly, this additional uncontrollable risk can be shared or mitigated.

Christian Dolderer

Lead Research Analyst