The world of transportation changed in August 2020 and February 2022. The reason for that is the implementation of the EU’s mobility packages 1 & 2, two sets of rules preparing the ground for changes in the road transport sector. Major impact on the structure of the transportation market was expected, especially with regards to available transport capacity and the use of cabotage (the right to operate and transport goods between two places in the same country).

Through the analysis of publicly available data on European transportation in combination with Transporeon’s platform data, we’re able to provide a 360° view of the transportation market. The article answers the following questions over the course of this article.

How did the EU mobility packages influence the European Market?

Are the effects solely linked to the package or are other factors influencing the market such as the weakened economy or the conflict in Ukraine?

How does cabotage usage influence spot rates?

How will the market situation influence the upcoming months and years?

The development of the cabotage market

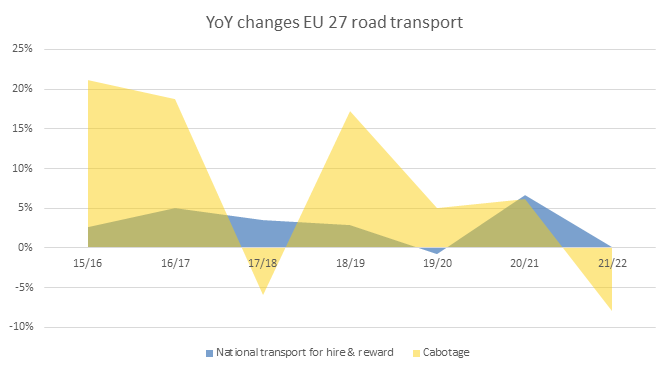

While the growth for European transport for hire & reward stagnated in 2022 (+0.1%), cabotage transports declined by 7.9%. How can we explain this major difference in market development? The following analysis is based on Eurostat data from August 2023, which we used to show the development of European cabotage transports and national transports for hire & reward on an aggregated level.

Source: Own calculation & visualization based on Eurostat data (road_go_na_tgtt and road_go_ca_hac in tonne-kilometre)

While we see that national transports for hire & reward evolved in line with the economic development, cabotage showed a growth over the years especially led by Germany and France. In 2015 cabotage accounted for 6.3% of the national transport for hire & reward jointly in these countries and reached a preliminary peak of 10.8% in 2021. A more detailed look into the cabotage figures itself revealed that this evolution is mostly linked to the success of carriers from two countries. Not surprising for industry followers: they are Poland and Lithuania. Carriers from those two countries almost constantly gained market share and developed themselves from 33.1% market share in 2015 up to 57.1% in 2021. They became the alternative solution to national carriers by leveraging their advantages, especially on driver costs. At the same time, they built up their own high quality services and entered from subcontracting into direct contracts within a cabotage environment.

In 2022 this trend stopped however. As the stricter social and business regulations came into force in 2022, one conclusion is obvious: The decline of cabotage usage is connected to the effects the mobility package had. The question is, to what extent can we be sure about that? How have other developments like the economic downturn or the war in Ukraine influenced the transportation market? In a quest to single out the effect of the mobility package, we used data showing the percentage of cabotage transportation and which countries were most affected.

Singling out the impact of the Mobility Package

The theory behind this is simple: If the impact of the reduction in cabotage is related to the mobility package, cabotage performed by Eastern European carriers must show a decline in overall transport performance and market share. So if the theory is correct, carriers from Eastern European countries are experiencing a loss in transport volumes, greater than the decline in the general market.

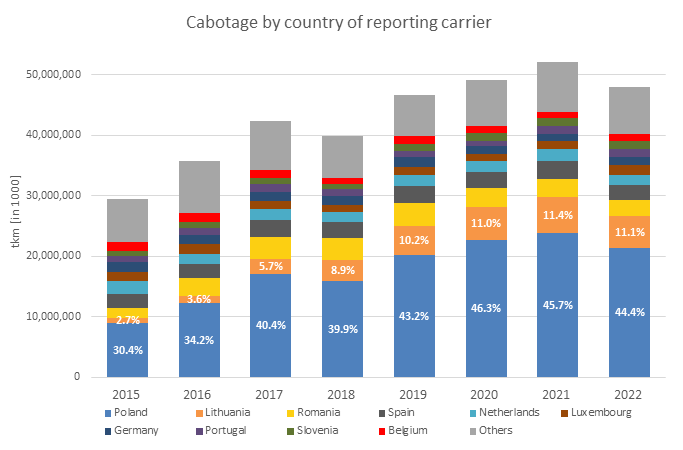

Source: Own calculation & visualization based on Eurostat data (road_go_ca_hac in tonne-kilometre)

The figures show that cabotage within Europe was mostly driven by carriers from Poland and Lithuania. It further confirms that cabotage transports decreased in 2022 for both. Combined with the visible loss of market share the theory above can be confirmed, too.

A more detailed look into individual country figures also reveals that the drop in cabotage in 2018 is different to the recent one. In 2018 all countries showed decreases while in 2022 Western European carriers showed increases (+6.4%) and Eastern European carrier decreases (-9.5%) in cabotage performed. Although the reasons for the 2018 decrease remain in the dark, the difference in the 2022 figures strengthens the hypothesis of a mobility package implication. Within the above listed top 10 countries of carriers performing the cabotage; Germany, Belgium and Luxembourg reported increases of >15% in comparison to 2021. This is interesting because it opens an additional view into the structure of the market. There are several plausible reasons for this gain in market share. Firstly, Western European carriers profit from the alignment of costs and thereby gain market share as their offering becomes more competitive. Or Eastern European carriers opened branch offices and shifted parts of their fleets to Western European countries, as a second possibility. Unfortunately, there is currently no possibility to prove or underline which of these reasons is the most likely one for the increases. We guess at the end both reasons are valid and main contributors to such a shift of market structure.

What does this mean for the market?

An immediate question crossed our mind once we thought about the above implications: What happened to the trucks that used to perform cabotage in Western European countries previously? This can’t be simply explained by an increase in inefficiency on the market and trucks driving around empty. Perhaps some of these trucks also have been relocated to Western European countries as announced in the newspapers. However, most of them either returned to their home countries to provide services there, or they were gradually phased out.

Several Eastern European carriers gave an initial response when they announced that they would be changing their business model in 2022. In essence, they announced to focus more on regional and long-term orientated lane & network business than performing a spot-market based “taxi” service throughout Europe. In consequence they should have brought more capacity into their local markets. If so, we ought to be able to confirm this with our capacity KPIs.

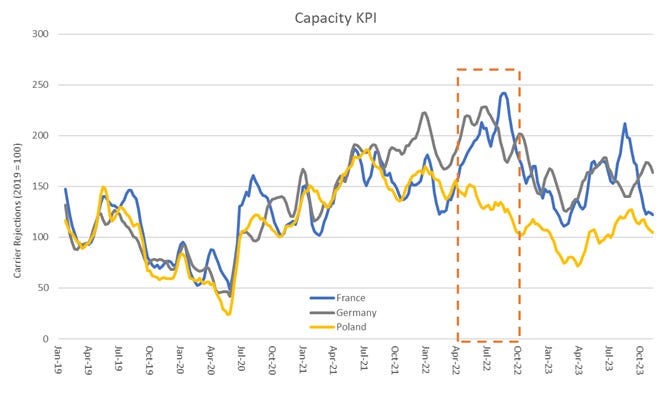

Source: Contracted load rejections, Transporeon Market Insights – own calculation & visualization

The above chart shows the development of contracted load rejections per country. A transport is thereby counted as rejected if the first assignment attempt is timed out or actively rejected by the contracted carrier. We clearly see that the three markets (France, Germany, Poland) exhibit a similar trend until 2022. During spring 2022 the rejections in Poland decreased while in France and Germany they climbed to new heights. After reaching new baseline levels in Q4, we see in 2023 again a coupling to the overall trend & seasonality. So, what happened during spring? The war in Ukraine started with a tremendous impact on the market, but why was this different in Poland?

During spring 2022 newspapers reported that Ukrainian truck drivers headed back to their home country to fight or be with their families. As they are often employed by Polish carriers this effect must be even stronger and visible within the numbers for Poland. The data clearly shows that the local capacity situation eased despite the lack of drivers. Consequently this is due to another factor. This brings us back to the enforcement of the new mobility package regulations at the same time and the hypothesis mentioned earlier, that Polish carriers most likely changed or adapted their business strategy and focused more on the local market. But what does this mean for the market?

We can still see, even though we are overall in a smooth capacity situation throughout Europe, that rejections in Germany (by far the biggest cabotage market) are elevated compared to 2019 levels. If we have a look to a near future when the economy picks up again, a fast progressive worsening of the capacity situation will be granted – with spot rates reacting fast.

In our attempt to further back this hypothesis we analyzed all German domestic spot transports on the Transporeon platform. We clearly identified that cabotage carriers operate more frequently on the spot market than on the contracted market. We also confirm that around 70 to 80 % of all cabotage spot transportation is carried out by Eastern European forwarders, so we can clearly foresee two things. Firstly that the spot market will react faster to changes in demand than before, and secondly that spot rates probably overshoot any usual seasonal behavior.

Conclusion

In our view we observe two major implications. We see the intended alignment of production costs and structures for eastern European carriers to protect western European standards. But we can also identify the side effect of decreasing capacity in Western European countries which may not be directly intended but is probably knowingly ignored. The softened economy is only helping at first glance by mitigating current direct impacts. In the long run, however, this is a disadvantage as it will further fuel a future capacity gap as carriers are currently downsizing their fleets. This development is being accelerated by markets such as Poland, where additional capacity entered due to the explained change in business models. This currently is a very competitive market and in favor of shippers. If we now envision the economy and demand for transportation to pick up again, we have a high risk of insufficient supply as the available capacity got reduced by both external factors (mobility package & softened economy).

Depending on the speed of the economic recovery it could even repeat the catastrophic supply situation as experienced in the first half of 2022, especially in western European countries. We acknowledge that this scenario is rather unrealistic but still possible if we experience a resurgence similar to the period following the COVID shutdowns. A more conservative and admittedly realistic projection would suggest that Germany, France and other western European markets will face capacity squeezes especially during peak seasons. First signs into such a development will be spot rates climbing and overshooting usual seasonal developments.

Actions usually lead to reactions and reactions will trigger new actions; the only certainty in the transportation market is a fast and constant changing environment and players reacting to it. So, buckle up; comfortable and easy years in transportation and supply chain management are a thing of the past.