Diesel: The Necessary Evil facing the End of Traditional Fuel Costs Calculation in European Freight Rates

The impact of fuel on European freight rate levels and the end of fuel costs as we know it

The rise in diesel prices to unprecedented levels in 2022 sent shock waves throughout the industry. Many shippers swiftly switched into crisis mode, implementing emergency plans to mitigate risks and keep carriers in the business. Now that diesel prices have returned to rather “normal” levels, it is worthwhile to investigate the factors influencing diesel price trends, its impact on transportation and future projections. Because one thing is certain: the expenses will increase in the long run, surpassing the level of 2022.

Factors influencing diesel price

Diesel price is a significant cost component in the European trucking industry. Despite its importance, neither shippers nor carriers are in control of diesel prices. Nevertheless, understanding the factors that influence diesel prices can help track their development. The graph below shows the evolution over time as published by the European Commission Weekly Oil Bulletin. At the same time, it also visualizes the price volatility and the unequal price levels among major European countries.

Diesel price evolution over time

Source: European Commission Weekly Oil Bulletin

But what is actually triggering these different developments? To understand this, let’s examine the cost elements of diesel price, which can be divided in two categories: production costs and local taxes & duties.

Production costs include the costs of crude oil, which is the main component of diesel, along with refining, distribution, and marketing costs. Crude oil is produced globally from sources such as oil wells, deep sea extraction, or hydraulic fracturing. The origin and the form of extraction will determine the underlying price per gallon. Refinement costs are associated with the process of converting oil into petrol or diesel. In this process, the ratio of biodiesel to diesel derived from crude oil can significantly impact the price of the final product. Since the production of biodiesel is more expensive, the blend of both components determines the price level of diesel sold at gas stations. For instance, in Sweden, at the start of 2024, the admixture of biodiesel was reduced from 30,5% to 6%, representing the minimum requirement by European legislation. This resulted in a 25% drop in diesel prices at the beginning of the year.

Additionally, the distribution and marketing costs include the expense of transporting the diesel from refineries to gas stations via pipelines, ships, trucks etc. It also consists of labor, property and equipment costs at gas stations.

Diesel or energy in general is taxed by each country individually. These taxes can be classified as energy taxes and value-added taxes. In recent years, carbon taxes have become increasingly prevalent as some countries have used the diesel price to levy a tax to steer energy consumption, and more countries are expected to adopt this approach.

These are the pure cost factors that determine the cost for providing diesel to the end consumer. But as oil is a daily traded commodity around the world, the diesel price is moreover subject to market forces affecting the price levels as well. Especially the economic climate, supply and demand balance, and political situations can all cause significant price movements. This became particularly evident during the 2008/2009 economic crisis and the war between Russia and Ukraine in 2022.

Additionally, the USD-EUR exchange rate affects diesel prices, as oil is primarily traded in US-Dollars. On top of that, the current season of the year or even the time of the day can locally influence the price levels (e.g. Easter, holiday season). This makes diesel prices subject to a vast array of factors beyond plain production costs and taxes.

When considering the diesel price and its respective tax share in each European country, the current diverse European reality becomes apparent. The graph below shows the average diesel price of 2023 and the related tax share for each country. diesel prices range between 1,37 €/liter (in Bulgaria) and 2,02 €/liter (in Sweden), a difference of 47%. Meanwhile, the tax share ranges between 38% and 52% in 2023.

Diesel price vs. tax share per country

Source: European Commission Weekly Oil Bulletin, own calculation

Impact on Freight Costs

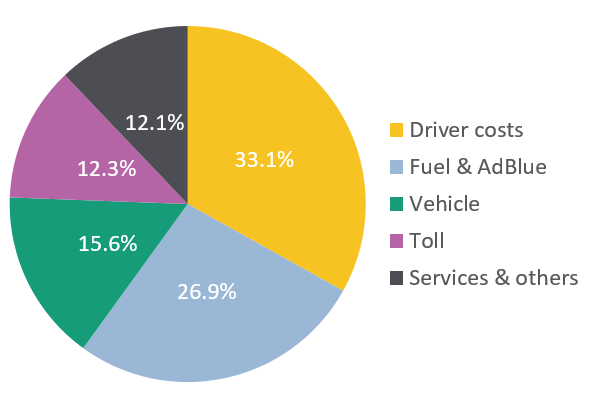

Transferring these diesel prices to Full Truck Load transportation reveals a diesel share of 27% (including AdBlue) in 2023, according to our proprietary Transporeon cost model. This makes diesel the most significant cost element, second to only driver costs. However, this percentage may fluctuate for individual transports due to variations in operating countries, the type of truck engine used, or the driven distance among other factors.

FTL freight cost elements 2023 - European average

Source: Transporeon Market Insights

Needless to say, this model relies on several assumptions such as the engine type used, the fuel consumption rate and the refuel country. Significant savings can be realized, particularly in relation to the refueling country, due to the already mentioned substantial differences in diesel prices between countries. For instance, in Bulgaria, the diesel price was 16% below the EU average in 2023. On the other hand, truckers in Italy paid 10% more than the EU average, and even 31% more than in Bulgaria representing an impact of approx. 8 percentage points on the overall freight rate level.

While it is not always possible for carriers to exploit the largest arbitrage opportunities, they can often choose to fuel up in the cheapest country en route. This strategy provides a particular cost advantage to Eastern European carriers. Some trucks can fuel up to 1500 liters, which is the maximum amount due to dangerous goods regulation.

But even short border crossings can offer some cost-saving opportunities. To demonstrate, we analyzed price differences between adjacent countries in 2023. The most significant cross-border savings could be found between Bulgaria and Greece (19% saving potential), Poland and Germany (16%) and Luxembourg and France (15%).

Nowadays, route planning tools with optimization strategies can take care of these price differences and automatically calculate the cheapest option taking into account various variables. This might provide a cost advantage for the carriers, helping them compete in the market and maintain margins in a low margin environment.

Yet, the overall question remains: what determines freight rate development? Is it mere fuel, or do other cost elements drive rate development? The below graph shows the evolution of diesel price, the gross rate level (all-in rate incl. the carrier’s profit and risk premium) and the net rate level (gross rate without diesel component) over time.

Until 2018, gross rates have been largely driven by diesel prices, as the net rate stayed quite stable. This changed in 2018 when increased capacity shortage shifted the balance of power and carriers were able to enforce higher prices while diesel prices decreased. That was followed by a dip due to Covid pandemic, when both diesel price and gross rate dropped. However, these changes were nothing in comparison to the price hike that was following due to the Russian invasion into Ukraine. With diesel prices reaching unprecedented levels, the European freight market was hit hard, and rates followed the diesel price curve.

Impact of diesel price level on gross rates

Source: Transporeon Data, own calculation

Interestingly, in 2023, rates remained high, due to increased non-fuel cost elements following overall inflation. Nowadays, we are entering a period when freight rates are less determined by fuel prices, but rather by other cost elements, which have now reached a new level. Therefore, the current pressure on freight rates comes from various directions.

The uncertain outlook

One of the top questions we are facing is, how will diesel prices develop in the near future? Given all described influencing factors, it's clear that precise predictions are impossible. Looking ahead, the picture becomes even more uncertain.

With new engine technologies on the horizon and the political goal to reduce carbon emissions in the transport industry, there will be additional variables to be considered in the equation.

The implementation of the Emission Trading System for the road transport sector (ETS 2) by 2027, latest in 2028, will bring a lot of changes. The carbon emission certificates will be sold to fuel suppliers rather than end users. These suppliers will be required to purchase and surrender allowances to cover their emissions. Most likely, these costs will be passed to the end consumers via the diesel prices, encouraging more climate friendly behavior. The price for these certificates will be fixed for the first three years at 45 € per ton carbon emission. For the following years the price will be auctioned making future developments uncertain. But as the amount of certificates will decrease over the years, it is fair to assume that the certificate prices will rise considerably.

Meanwhile, there will be enhancements of alternative technology solutions that produce less CO2 pollution. As such, diesel will increasingly be supplemented by other energy sources, requiring a reevaluation of traditional cost impacts on freight rates.

While many aspects of diesel price evolution remain uncertain, one certainty is that with more and more consumption of oil, the supply will diminish in the future. The key influence factor on the further development will be the behavior of the market players. In the transportation world there are two options: investment into other engine technologies or continuing to combust fuel. As the new technologies are more expensive, at least for the moment, an increase of cost is inevitable, if the political will to intervene persists. In the long run, this will likely result in higher freight prices. This underscores the need for frequently updated floaters. But floaters should then not only cover diesel costs, but rather all energy costs related to the truck movement to fully share the risk between shippers and carriers.

Thomas Hang

Lead Research Analyst