Evaluating the European Truck Capacity Market: A Mid-Year Update

Market Monday - Week 29 - the differing capacity situation compared to 2023 manifests. What are the implications for the rest of the year?

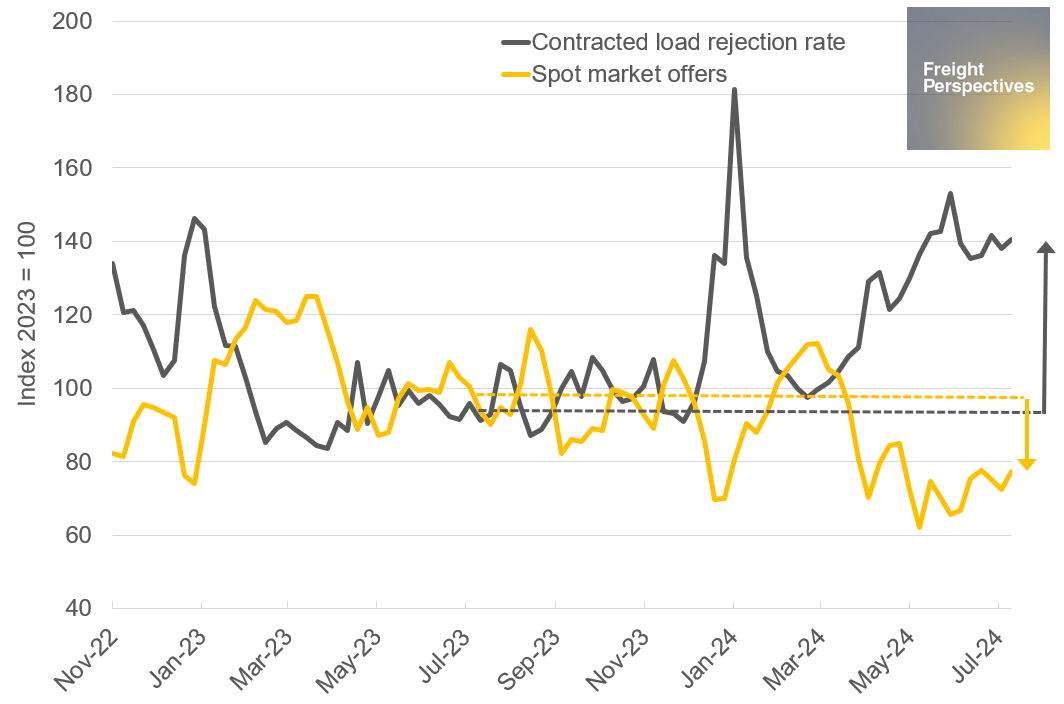

In this episode of Market Monday, I’ve updated my evaluation of the seasonal trends of contracted load rejections (transports that are either timed out or rejected by carriers) and offers on the spot market. These two KPIs serve as our main indicators of short-term available truck capacity in the market. Typically, rejections increase and offers on the spot market decrease around public holidays. This time, they were triggered by public holidays, but the entire market situation has since evolved.

This update reveals significant and strong reactions from these KPIs, confirming the expectations from my last post in May.

The change in available capacity is clear. The chart below reveals, there is no significant re-alignment to the situation of 2023 visible for both KPIs.

Comparison of European rejections and offers to 2023

Source: Transporeon Market Insights, own illustration and evaluation

I expect this general trend (non-alignment to the situation of 2023) to continue in the coming months. Slight improvements on the offer side are expected as a counter to the rising and elevated spot price levels. Meanwhile, the longer the spot prices remain elevated, the more pronounced the alignment of spot offers becomes, following the basic principle that high and attractive demand will find its needed capacity.

For the contracted side, this unfortunately means no good news, as rejections are likely to remain elevated. This is because some trucks that primarily served the contracted side in recent months will probably increase their spot market service share, following the higher margins possible in this segment.

In the midterm, increased spot market utilization and rising pressure on contracted prices are expected. The next milestone for evaluating available capacity will be after the softer summer period, with September values revealing the future trend.

Christian Dolderer

Lead Research Analyst