As employees return to their desks after a nice and long summer vacation (me included!), it is time to recap the recent developments in the European transportation market. Certain countries are more affected by the summer season than others, and this week’s edition of Market Monday will take a closer look at the spot rate trends in Italy.

In recent weeks, the festivities around Ferragosto have been the dominant event in Italy. This is usually reflected in the figures from Market Insights - our Market Intelligence solution. With many factories closing down and truck drivers taking their well-deserved summer breaks, the Italian transportation industry slows down.

In recent years, this “tradition” has been disrupted by external factors such as

Covid-19, material shortages, and rebound effects. However, this year appears to be more traditional, with no major negative impacts. Let’s explore how Ferragosto has influenced the Italian transportation industry this year.

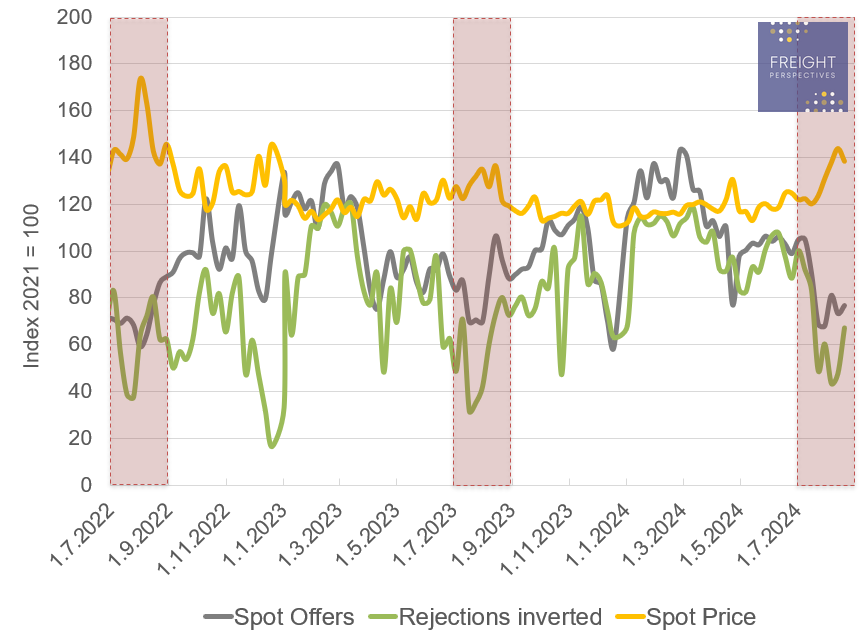

In the graph below, you can see the evolution of spot prices, spot offers, and inverted contract rejection rates for Italy domestic of the last two years. For an explanation of these figures, please refer to one of the previous Market Monday articles.

Italy domestic road transportation

Source: Transporeon Market Insights, own illustration and evaluation

The periods marked in red represent the summer holiday season in July and August of each year. Over the a long-term, dips in spot offers and inverted rejections typically appear during Christmas, specific other holidays (Easter, November 1st) and particularly in the summer months. During these times, carriers reject more contracted transports and are less active on the spot market, indicating reduced capacity. This is usually accompanied by a short-term spot price peak due to decreased competition for spot loads.

Focusing on the Ferragosto periods, we can see a retreat by carriers in all three instances. However, the impact on spot prices varies. In 2022, there was a substantial increase in spot prices, demonstrating that overall demand for transportation remained high during the summer, allowing carriers to charge more. In 2023, spot prices also increased, but to a lesser extent. This year showed a significant decrease in spot offers and inverted rejection figures, resulting in a 20-point increase in the spot price index, equivalent to roughly 15-20% higher spot prices compared to June 2024. The Ferragosto impact on spot prices this year is greater than last year but not as high as in 2022. This results in a tight capacity at the moment. However, based on past trends, this condition is not expected to last long and will likely relax in the coming weeks. As the pre-Christmas demand increases, the overall situation will change once again.

Thomas Hang

Lead Domain Expert