Forecasting the Future: Will European Spot Prices Continue to Outpace Contracted Rates

Market Monday - Week 39 - road transport spot rates climbed to new heights while contracted market remains stable

In February, I initiated this analysis to present my perspectives and forecasts on the trend of spot prices relative to contracted price levels. We also tackled this data and its key implications during our Freight Perspectives session at the Transporeon Summit in Vienna last week.

The following chart centers on the overall distribution of spot price levels compared to contracted price levels across all the markets we track. To ensure accuracy and relevance, we used a truncated mean to exclude outliers.

Difference between spot and contracted rates for the past 23 months in Europe

Source: Transporeon Market Insights, own evaluation & illustration

Each value represents the difference between spot prices and contracted prices within a specific week (Index 100). For instance, in week 36 of 2024, spot prices peaked at 15,4% above contracted price levels.

What is different to 2023?

The main difference from 2023 is the available truck capacity on the market, impacted by slight demand increases in some industries and countries. However, due to overall low demand; reductions in fleet, regional supply imbalances or a reduced efficiency in carriers’ networks are the primary reasons for the weaker capacity supply.

Geographical Impact

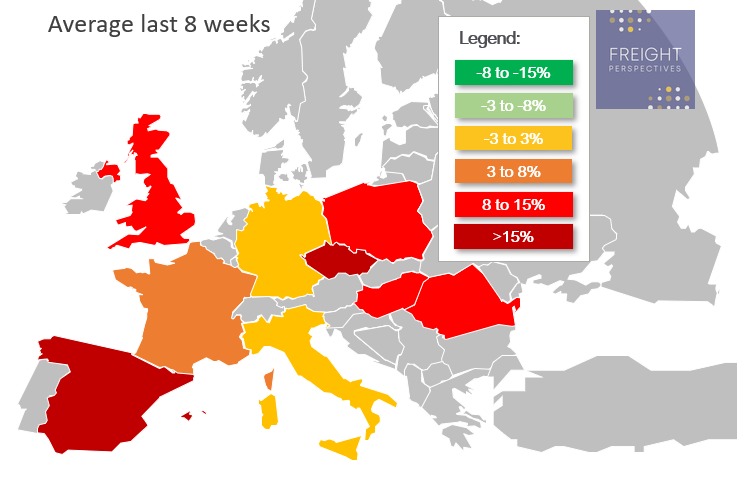

To answer the question: Is this happening everywhere, or are some areas in Europe more affected than others? We prepared the following overview, highlighting major countries and their current spot rate situation compared to their contracted prices.

Difference between spot and contracted rates across Europe

Source: Transporeon Market Insights, own evaluation & illustration

Comparing this year´s data to 2023 reveals a striking shift in three major European countries. Germany (+9.2 percentage points), the UK (+8.6 percentage points), and France (+3.8 percentage points) are the powerhouse nations driving a broader trend across the continent. In fact, our latest analysis shows that in 64 out of 73 country-pairs, spot prices now exceed contracted levels.

What can we expect in the coming weeks?

Source: Transporeon Market Insights, own evaluation & illustration

In blue, I’ve revised and extended my forecast on the potential trajectory of the spot versus contract rates graph until the end of October. Should my predictions prove accurate, we will experience an extended and further elevated phase where spot prices surpass contracted levels, with only minor variations. This trend maintains significant pressure on contracted market prices and particularly rejections, mirroring the altered capacity dynamics since 2023. The key question remains: How long will contracted rates stay steady before they begin to rise again?

Are we witnessing the erosion of contracted market principles?

Reflecting on what could cause this situation and why contracted rates have remained stable so far, I can consider an erosion of the former principles of the contracted market. Thanks to the people I met during the Transporeon Summit in Vienna; the discussions around current market dynamics and experiences nuanced understanding of both carrier`s and shippers` perspectives which have been instrumental in assessing the current situation and forecasting potential future trends.

In the past (prior to 2020), the contracted market operated simply and smoothly: prices were fixed, and agreed capacity was granted during the contracted period. Over the last four years, various events have affected the market, leading to changes in how it operates.

On the sippers side, procurement teams are actively pursuing cost reductions, leveraging the current economic softness to negotiate more favorable rates. On the other hand, carriers seek loads to keep their trucks running in difficult times. While this might initially seem ideal for procurement with significant price reductions, it can cause bigger hurdles elsewhere. For instance, if the capacity guarantee is not fully given at the contracted price levels. In response, logistics operations departments must adapt swiftly. They are increasingly turning to back up carriers and spot market to mitigate these effects. However, this urgent need leads to elevated transport costs and spot prices. This dynamic creates a self-reinforcing cycle. As spot prices climb considerably above contracted levels, carriers may be more inclined to reject contracted loads in favor of more lucrative spot market opportunities. This trend could further drive up spot demand, as carriers find they can better cover their costs in this segment compared to the contracted market.

But, the key question is: How could this cycle be stopped?

Further demand decreases, capacity additions or a significantly increased network efficiency do all have the potential to stop this, but their probability of occurring is very low in these times. Leaving contracted price increases as the most likely consequence to stop it.

However, given the current high cost cutting pressure on shippers' side this is not an already pre-decided development. The current situation could also be prolonged until the next effect will hit the market. In case of significant demand increases for instance, new spot peaks would be the logical consequence.

Interesting and challenging times lie ahead in the transportation sector, and we commit to closely monitor the developments while also examining all other market components for potential changes.

Christian Dolderer

Lead Research Analyst