High Heavy Truck Registrations in Europe Despite Challenging Economic Landscape: What's Behind the Surge?

The latest statistical releases reveal increasing registrations figures for heavy trucks across Europe. In comparison to previous years, it is not only eastern European carriers that accounted for this development. Now, western European carriers are also demonstrating heavy investments into their fleets.

New heavy truck registrations 2023 vs. 2022

Source: ACEA, own illustration

Estonia, Denmark and Poland are considered outliers in 2023. However these countries had already shown high investments from 2021 to 2022. A closer look at the details of these figures offer no surprise - 2023 marked a year with almost record-high new registrations of heavy trucks in Europe. The registrations increased continuously since Q1 2022, quarter by quarter, and reached their peak in Q2 of 2023.

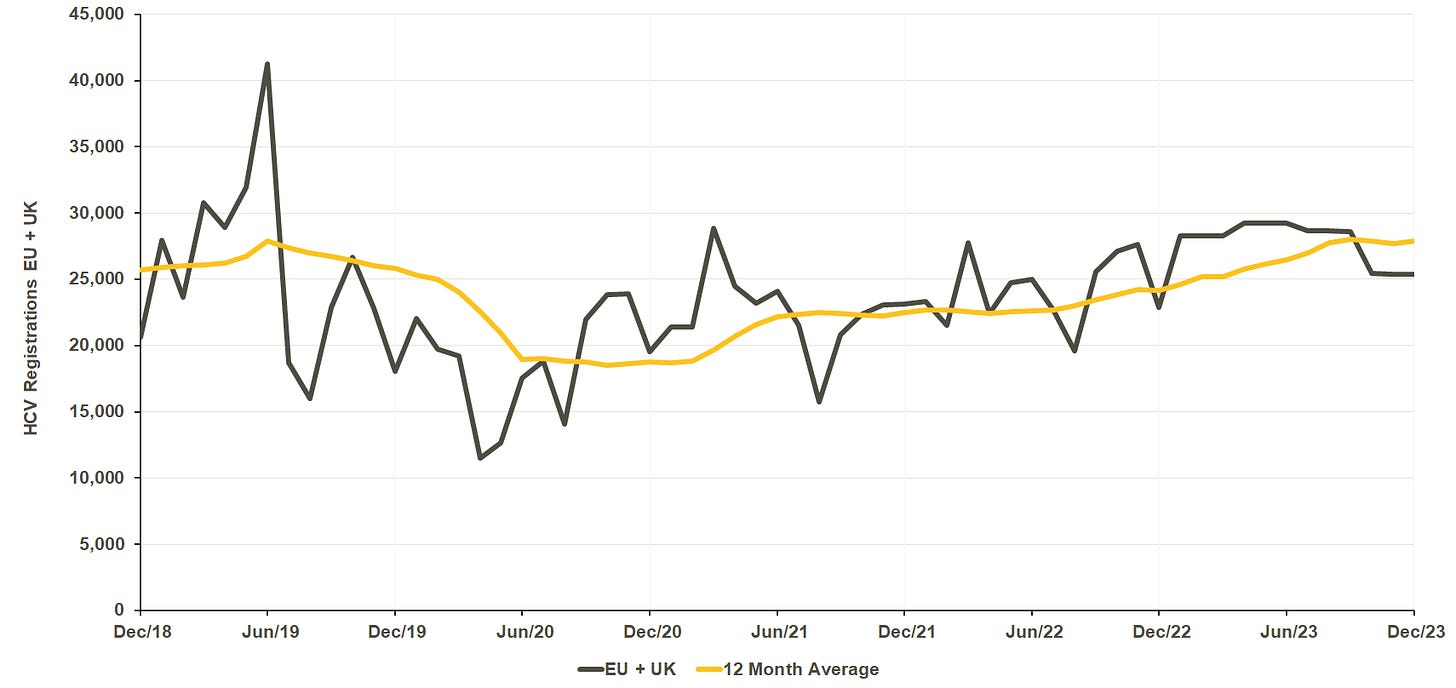

Heavy truck registrations in the past 5 years

Source: ACEA, own illustration

But how does this development of record high registrations fit into the current economic landscape, which is marked by weak economy, high cost pressure and low demand for transportation?

Well, there are a few possible explanations. The first one is the lead time between ordering trucks and their assembly and registration. This lead time can range from 6 to 12 months, especially during periods of high demand for new trucks and shortages of semiconductors that impact production efficiency. So actually the registration figures above mirror investment decisions made around 12 months ago. Although the economy was already impacted by the war in Ukraine, the situation during this time enabled carriers to literally print money due to high demand for transportation and the resulting high prices achieved on the spot or contracted market. Consequently the margins on the carriers' side saw peaks as well.

This marked a great opportunity for carriers to reinvest and modernize their fleets as financials were looking good.

Secondly, history has shown that there is often an increase in investment tendencies into existing and well-known technologies or truck types, prior to a technological transformation. This means that carriers likely took advantage of this phase to modernize a large portion of their fleets with proven truck types and technologies. Allowing them to monitor in the face of future developments in alternative engines without exposure to pressure for short term reinvestments and modernization.

The Q4 2023 values indicate a change in trend, with an overall decrease of 14% compared to Q3. The root cause of this drop cannot be attributed to a usual seasonal effect as previous years did not show a similar tendency. It is likely that this trend of reduced overall registrations will continue into 2024 due to the unfavorable economic situation and increasing financial uncertainties for carriers.

On the other hand, Q4 registration figures revealed a significant increase in electrified truck registrations, while total registrations decreased. Electrified trucks accounted for 1.3% of total registrations in Q4, which may seem low. However, if we take into account the non-existence of a charging infrastructure network and yet limited suitable fields of applications, those 851 new electrified trucks within Europe in Q4 already represent quite an amount of pilot projects or use cases kicked off.

The chart below provides the answer to the question of who is driving this transformation and where the most use cases or pilots for electrified trucks have been initiated

Countries driving the electrified transformation

Source: ACEA, own illustration

The baseline of the index in the chart above is the EU average of 0.9% as a share of electrified trucks within 2023 total registrations (e.g. Swedens’ share of electrified trucks is 4.4% (0.9% + 3.5%)). It is not surprising that the Nordics and BeNeLux countries are at the top, given the structure of their markets and main business areas (regional high quality service) of carriers within these countries.

These business areas are ideal for piloting electrified use cases. This is different from many carriers in eastern European countries which often focus on international long-distance transportation.

Germany and France have also accelerated the transformation and almost doubled their Q3 registrations within Q4. If this trend continues, the EU average will also speed up as these two countries already represent 38% of total registrations.

Summary

Although the number of electrified trucks on the market is still relatively small, they have shown significant growth given the challenges they still face on the market. We can expect registrations of electrified trucks to rise fast, as new models will enter the market in 2024 and more shippers conclude their research on potential areas for implementation and consequently begin pilot operations.

One major hurdle will be that shippers need to actively search for operational conditions within their networks which could fit to an electrified operation. Waiting for carriers to provide a fully developed solution will not be effective. This approach would not only delay the transformation but also result in a loss of competitiveness in the long run.

Regarding the high overall registrations in 2023, it does not necessarily mean that the available fleet within the market increased proportionally. A more realistic assumption is that, given the driver shortage and the overall economic situation, we most likely see a modernization of the fleet rather than a real enlargement. Although de-registration figures are not available - considering press releases mentioning fleet decreases combined with the driver shortage - we cannot ignore the possibility of a decrease in the available fleet within the market.

These high registrations won’t prevent the market to react when demand is picking up again, we will certainly see capacity shortages and high spot rates to come along.