Iberian Blackout: Assessing the Impact on Road Transport and Supply Chains

Market Monday - Week 20 - Road transport productivity draws a mixed picture

On April 28, 2025, a major blackout struck the Iberian Peninsula, with widespread power interruptions beginning shortly after 12:30 PM CEST and lasting for many hours. By the morning of April 29th, power had been largely restored. The event severely affected Spain and Portugal, with secondary effects noted in Andorra and parts of southwestern France. The disruption affected critical infrastructure, including telecommunications, transportation networks such as rail and air travel, and essential services like hospitals, bringing business operations and daily life to a temporary halt for millions.

In this analysis, I focus on the repercussions for road transportation, drawing insights from the Transporeon Execution and Visibility Platform. By comparing the number of transports matched and assigned on the day of the blackout against typical activity levels, we can gain insight into the extent of the supply chain disruption.

Source: Transporeon Execution and Visibility Platform

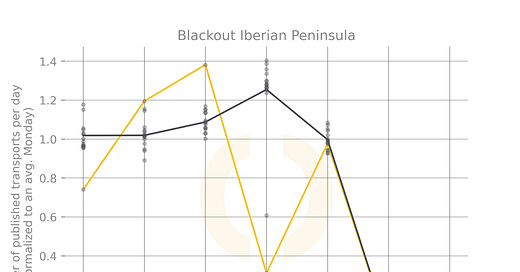

The accompanying chart illustrates transport activity on the Transporeon platform during the blackout week. Reference values, indicated in black and grey, help to identify anomalies and external impacts. On Monday, April 28th, transport activity showed a notable reduction, approximately 20% lower than the average for other weeks in 2025. Despite the decrease, the majority of transports were matched, suggesting either partial system functionality or a concentration of matching activity earlier in the day.

Thursday, May 1st, was a public holiday, which predictably resulted in lower transport matching volumes. Data from Tuesday and Wednesday suggest a combination of recovery from Monday's disruptions and a frontloading effect ahead of the holiday. Distinguishing between these effects is challenging, but such fluctuations typically correlate with significant shifts in key performance indicators, including spot prices and rejections.

Spot prices reached a new high for 2025 in week 18, recording an 11% year-on-year increase. Concurrently, rejection rates rose, while offer volumes fell to their lowest point of the year. The blackout undoubtedly contributed to pressure on these metrics, though the proximity of the public holiday complicates the precise isolating of its specific impact.

Another metric evaluating the blackout's effect is the total distance driven on the affected day, compared to typical productivity levels. The map below shows distances driven across Europe on April 28th.

Source: Transporeon Execution and Visibility Platform

The distinct bluish shading over the Iberian Peninsula clearly highlights a significant drop in transport productivity, with substantially less distance covered relative to the reference (March & April) and to the rest of Europe. Notably, areas around Barcelona, San Sebastian, Bilbao, and Barcelona appear less severely affected. This aligns with reports that power restoration progressed from north to south, resulting in shorter outage durations for northern regions. Areas near France, benefiting from interconnections with the French power grid, were only partially impacted. In the Basque region, power was reportedly restored within two hours. Additionally, factors such as solar-powered traffic lights in Catalunya and a general reduction in overall traffic may have mitigated the impact further.

External events of this nature introduce considerable complexity to the market, initiating a chain reaction throughout the logistics network. The combined effect of the blackout and the subsequent public holiday, continues to exert pressure, suggesting that in the absence of such disruptions, market conditions might otherwise exhibit greater stability.

Christian Dolderer

Lead Research Analyst

Trimble Transportation (Transporeon)