Introducing Freight Perspectives Pro - Your Essential Monthly Guide to Stay Ahead of Freight Industry Trends, Key Data & Forecasts

We've noticed a gap in the industry. Most market knowledge is siloed within companies and limited to interactions with customers and service providers, leading to biased perspectives.

We're changing that by offering deep insights, data-driven analysis, and practical intelligence to navigate the intricacies of global transportation. Our goal is to equip you with the knowledge you need to make informed decisions and drive success in your role.

We continue to offer our "Market Monday" posts for free, providing snapshots of industry trends. For those seeking more comprehensive analysis, we've introduced Freight Perspectives Pro, which includes MARKET RADAR as one of its main deliverables.

MARKET RADAR is your monthly dose of in-depth insights tailored specifically for logistics professionals in procurement. Here's what makes our offer indispensable:

European development of spot and contract rates, as well as forecasts

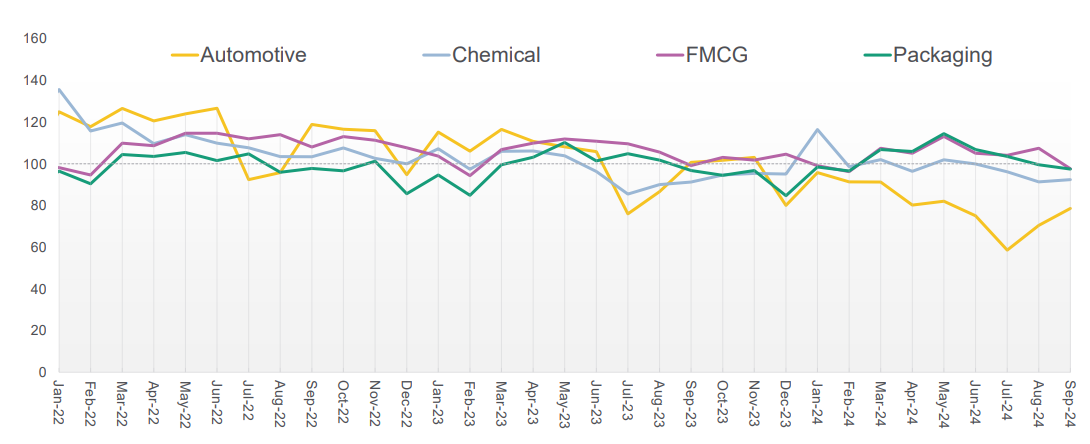

Trends in transport demand, broken down by industries and key markets

High-level overview of cost developments

Our proprietary European capacity index and trend

Major cost drivers over time (e.g. diesel prices)

Overall market sentiment analysis and assessment

Upgrade to Pro for comprehensive Market Intelligence

Market Radar is just one of the many benefits of our Freight Perspectives Pro subscription. By upgrading, you'll also enjoy:

Early access: Be the first to receive our latest reports and market updates.

Exclusive webinars: Participate in members-only sessions with our lead analysts.

Subscribing to Freight Perspectives Pro is simple. Visit our Substack page and choose the Pro subscription plan. To celebrate our launch, we're offering a 20% discount for the entire year to new subscribers who sign up by November 6th.

A taste of Market Radar: October 2024 highlights

Key takeaways:

September demand showed a less pronounced seasonal increase, remaining below 2023 levels.

Spot prices surged, nearly reaching 2022 levels, while contracted prices remained stable.

The automotive industry continues its rebound but remains at multi-year lows.

Market outlook:

Anticipate demand increases for October, following seasonal trends.

Capacity in Europe is expected to remain tight, below both 2019 and 2023 levels.

Continued pressure on contracted prices due to high spot prices and reduced capacity.

This is just a glimpse of the in-depth analysis you'll receive with each Market Radar report. Upgrade to Freight Perspectives Pro today and arm yourself with the knowledge to make informed decisions and drive success in your role.

In the following are some examples of the content included in MARKET RADAR.

Contracted and spot market rates on European level for standard and refrigerated equipment

Forecast for contracted rates and costs (TCO) for the upcoming 6 to 12 months

Demand (overall, industry, markets) and capacity evolution

Ready to dive deeper?

Download a sample of our full October Market Radar report below:

We value your input! Let us know what additional content you'd like to see in future Market Radar reports. Our goal is to provide you with the most relevant and actionable information from the transport market.

Your Freight Perspectives Team