Resetting the Pieces on the Maritime Chessboard

January 17th this year, with the Gemini Alliance, both Maersk and Hapag-Lloyd set the container shipping merry-go-round in motion.

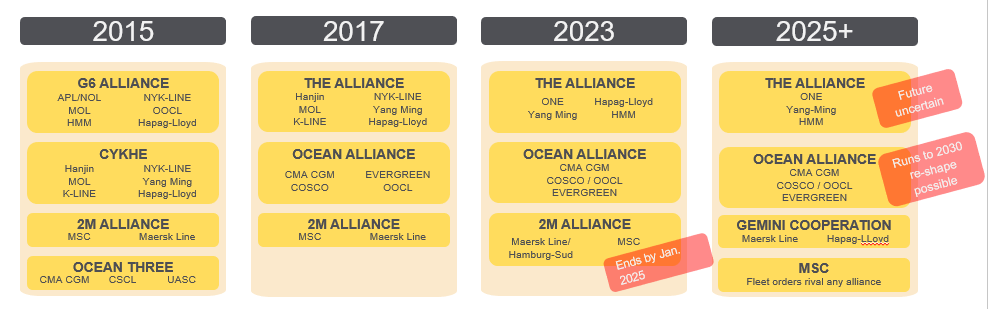

The end of CBER (EU’s Consortia Block Exemption Regulation) and the 2M split hinted that changes were coming, and Maersk took the lead to find a new partner.

Hapag-Lloyd seems like the perfect fit in terms of culture and size, but this move means saying goodbye to their current partners in The Alliance.

The Gemini Alliance will employ 290 ships, which accounts for nearly the complete VLCS fleets of both carriers.

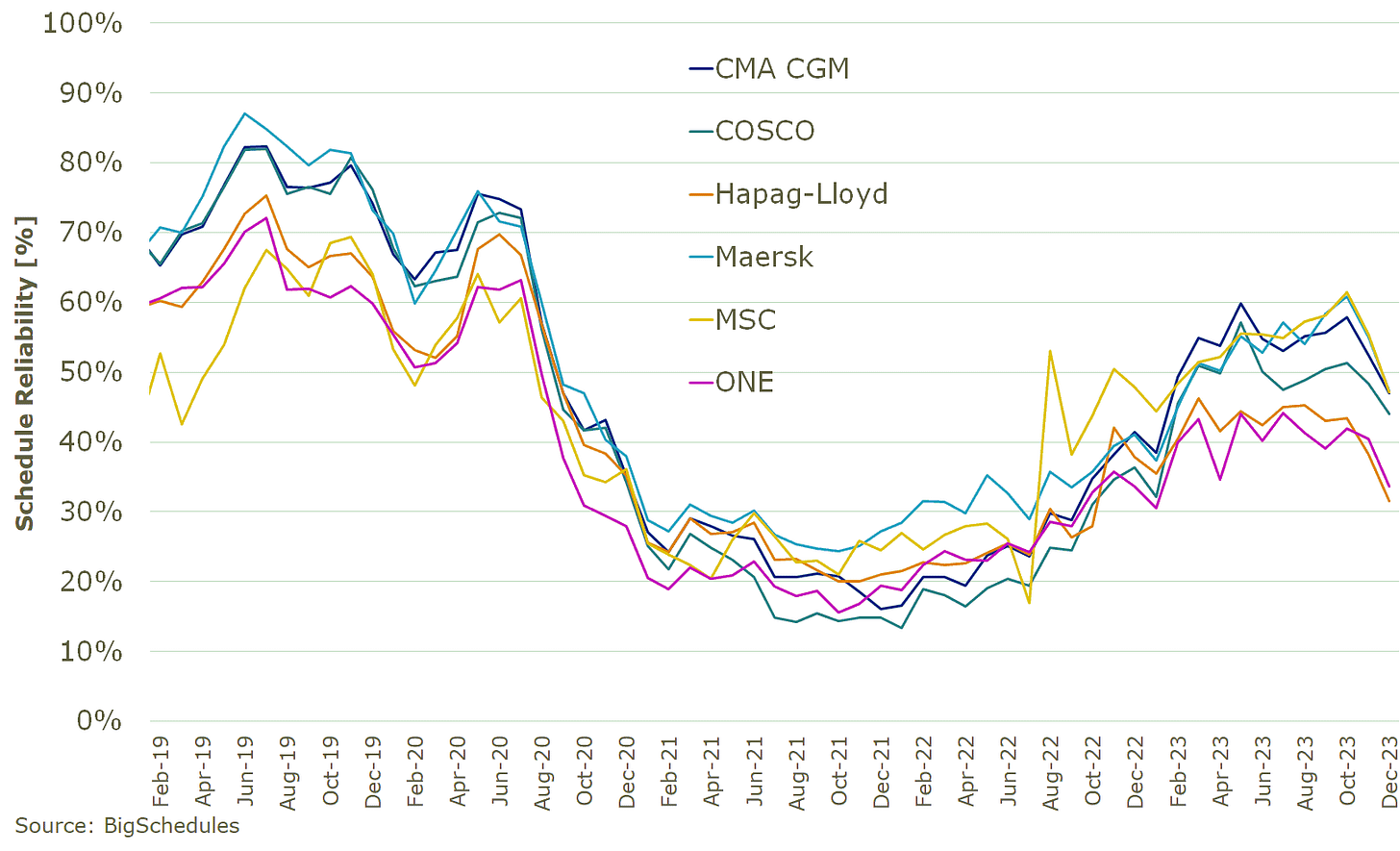

The Gemini Alliance has set an ambitious goal of achieving a 90% on-time schedule, which sounds fantastic. However, it's important to be realistic: reaching this target will be quite a challenge, considering the industry's historical performance. Even without the disruptions caused by Covid, which led to significant drops in schedule reliability (some as low as 10%), the overall industry average has never surpassed 60-70%.

So how will Gemini Alliance make 90% happen ?

One might question the decision to adopt a hub-and-spoke approach. Was it a clear choice, or a necessity driven by a limited number of vessels that forced them to reduce base ports? This strategy introduces complexities, transshipment risks, and additional costs. Moreover, it demands strict adherence to schedules to make it effective. This choice reopens the debate about deep-sea versus short-sea shipping and raises questions about who gets priority for berthing at the terminal.

It is also remarkable that the Port of Hamburg is not included as a base port. Hamburg being the home port for Hapag-Lloyd. Undoubtedly, the takeover of 49.9% of the shares in HHLA by MSC will have played a big role in this.

Considering Gemini's primary routes on the east-west axis, there's a need for smooth integration with the north-south network and lanes beyond the Alliance's scope. It remains to be seen if the hub-and-spoke approach will extend to operations outside the Gemini Alliance.

If we zoom in on the current Far East – Europe weekly capacity and we model it to the new Gemini Alliance, the size becomes apparent:

In rounded figures:

Gemini Alliance: 91.000 TEU capacity/week

MSC (standalone): 91.000 TEU capacity/week

The Alliance (-HLAG): 83.000 TEU capacity/week

Ocean Alliance: 148.000 TEU capacity/week

Source: Alphaliner - current operated capacity

This makes the Ocean Alliance in the current setup by far the largest alliance on the east-west trades. Interesting to see is that the capacity of MSC and Gemini Alliance on this trade are the same, which might suggest that MSC would not need an additional partner on this trade to make things work. It also suggests that there might be an opportunity for the current non-alliance shipping lines ZIM and PIL to find a spot.

And if we are bold, then why not envision ZIM joining MSC on the east-west as they already do and PIL finding a spot at The Alliance?

And what about Evergreen shifting to The Alliance? That would make the 4 groups more balanced?

Or will the ONE taking over HMM be the game changer?

Lastly: Could WanHai Lines replace Hapag-Lloyd in THE Alliance, especially if they revive plans for Asia-Europe services?

One thing is sure, the music is still playing and the dance is far from over.