Rising Spot Prices: A Self-Reinforcing Cycle in European Freight Markets

Today, we examine the current spot market sentiment and forecast trends for the coming weeks following numerous public holidays across Europe, with more still ahead.

Let's delve into recent market trends. The accompanying chart illustrates the dynamics between spot and contracted price levels across all monitored markets. The soft cycle observed in February and March aligned with our projections, as did the Easter rebound. Notably, December 16th marked an unprecedented peak in the spot-to-contract price ratio, while March 3rd marked the lowest spot price in the last twelve months.

Each data point represents the variance between spot and contracted prices for a specific week (Index 100). In week 51 of 2024, spot prices reached 22.7% above contracted levels.

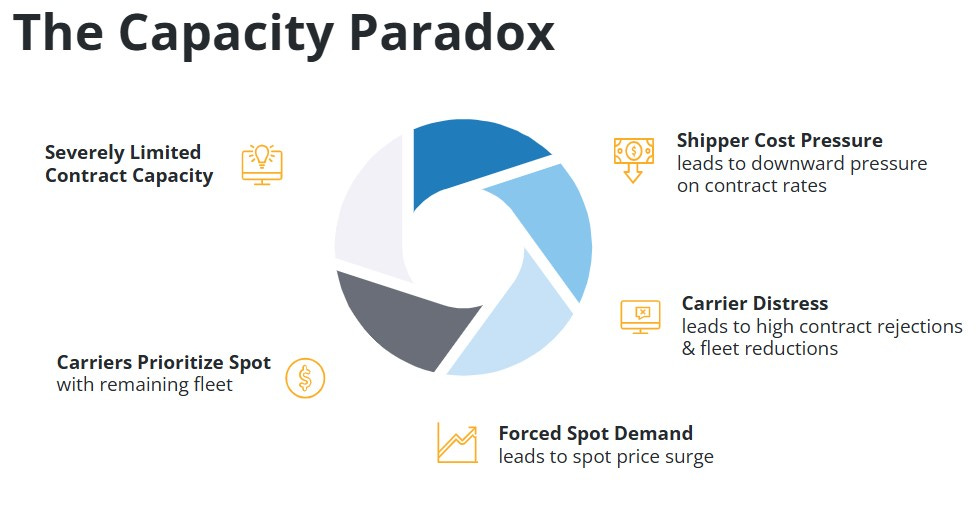

The market is currently trapped in a self-reinforcing cycle. As shippers try to avoid the elevated price level of the spot market by shifting volumes to existing contracts. However, the contracted segment hardly reflects current carrier production costs due to limited capacity and rising expenses. This forces shipments back to the spot market as urgent orders, driving prices even higher.

This paradox, with its self-reinforcing nature, is a key contributor to the current spot price heights. Our corridor-level analysis aims to assess which country combinations reflect this most, by revealing challenging areas for all market players involved.