Spot Prices for Domestic Road Transport in France Exceeded Predictions

Market Monday - Week 22 - Road transport spot prices in France increased by 29% compared to March of this year.

Four weeks ago I shared my expectations regarding the spot price trend in France. Now, after several public holidays and spot prices demonstrating the expected direction, it's a perfect time to recap what has changed in the meantime and also to update my predictions.

Spot prices are heavily driven by the market forces of demand and capacity. While demand is expected to remain stable overall, the market experienced and will further face reduced capacity. We observe this clearly with the decrease in number of spot offers within the past weeks.

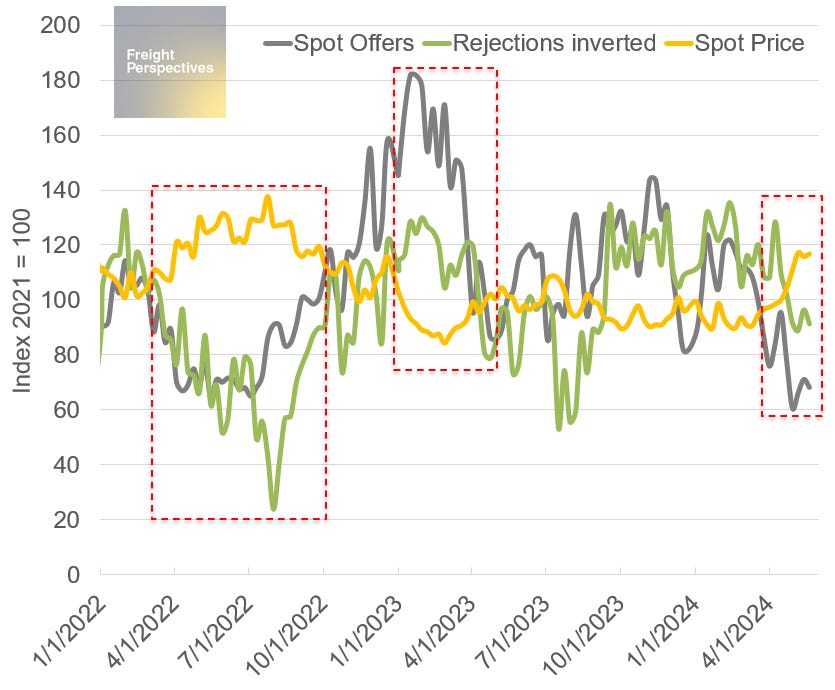

The updated chart below, which shows trends in spot prices, load rejections and spot offers for the French domestic market, serves as an illustration of market fundamentals. For a better visualization and aligning the contracted loads rejections with the offers, rejections are displayed inverted in the graph. Therefore, the decreases in this graph for rejections and offers both indicate an increasing effect on the price.

Source: Transporeon Market Insights, own illustration and evaluation

Due to its nature and seasonal effects the spot market is highly volatile. The first two highlighted periods confirm these basics. In my previous post I stated: “So far in 2024, the market has been relatively balanced, with no indicator outperforming or signaling a general trend change.” Well, looking into the updated figures I tend to withdraw or at least update this statement as the offers during the last 5 weeks show such an outperformance.

If this gap sustains it will also strongly impact the spot rates, as less competition on this market will be the consequence. Although rejections also show an impact they aren’t exceeding their expected values in the current situation. Therefore current spot rate levels are majorly influenced by a reduced competition and the lack of available capacity in this segment. While the contracted market appears more robust in France.

A theory I see, explaining all of this, would be Eastern European carriers averting from the Western European spot market due to low spot rates for the last one and a half years and the inconveniences related to the compliance with the Mobility Package. Increased bankruptcies and the reduction of the fleet seem to be the biggest consequences leading to the turn away. Recent press articles as well as released figures by the Polish Economic Information Center (Coig) reinforce this theory. The spot market in France (the second biggest cabotage market in Europe after Germany) would be strongly impacted as cabotage services are more likely to be offered in a spot environment.

That is why I expect the spot rates to decrease throughout this week after all the public holidays. But I also expect that they will stabilize near the current elevated level shortly after.

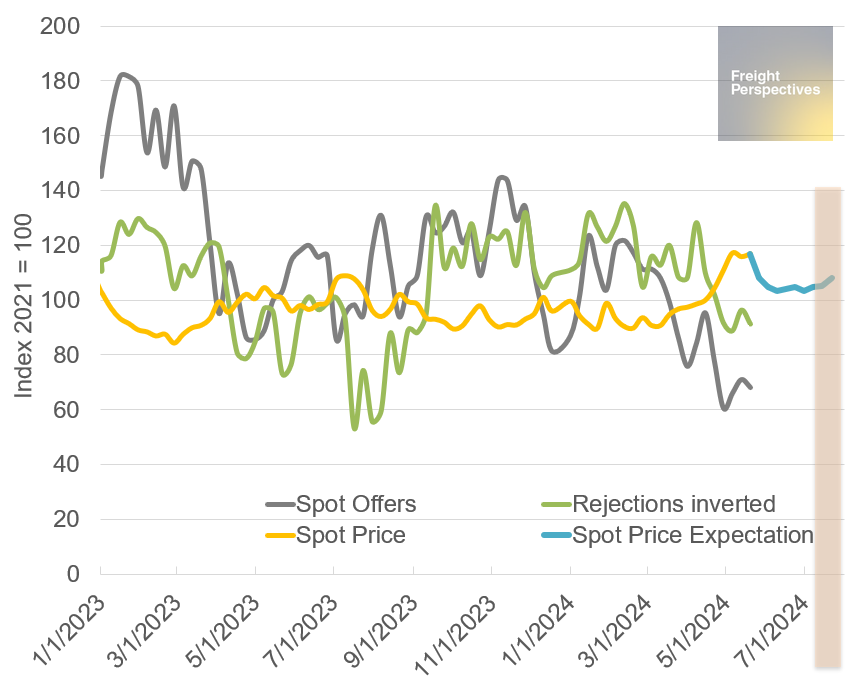

Source: Transporeon Market Insights, own illustration and evaluation

In July, I expect France and the French spot market to be again in the spotlight due to the Olympic Games. The preparations leading up to the games, as well as the event itself, will significantly impact transport operations. Factors such as road closures, the overall traffic situation, and increased security efforts, will clash against a rising transport demand associated with the events and will affect not just the Paris region but the entire country.

I expect the first effects to become visible in the beginning of July (as highlighted in the chart). Spot rates will then likely increase steadily and reach levels above the heights of May, while competition on the spot market is expected to further decrease.

Christian Dolderer

Lead Research Analyst