Understanding Road Transportation in Sweden

Market Monday - Week 19 - Facts, figures and insights into road transportation in Sweden

About this series

The transportation landscape in Europe represents one of the world's most sophisticated logistics networks, where over thirty countries intersect in a complex web of trade routes and regulatory frameworks. This comprehensive series examines the key transport markets that drive Europe's logistics sector, offering data-driven insights and practical market intelligence.

Our analysis combines real-world data from the Transporeon platform with official statistics from Eurostat, focusing primarily on full truckload road transport while maintaining relevance for other transport segments.

The Swedish road transportation market

Sweden takes the central position within the Nordic countries both geographically and economically. It relies heavily on an efficient road transport sector to support both its domestic commerce and its international trade. However, this sector currently finds itself at a significant juncture. After shakes of the pandemic and subsequent demand surges, it now faces issues from potentially softening demand, persistent and multifaceted imbalance cost pressures, tightening capacity constraints primarily driven by labour shortages, and the overarching, transformative challenge of decarbonization mandated by national and EU climate objectives.

The following overview will dive into the key components shaping Sweden's road freight market: we will examine demand trends, infrastructure quality and access costs, capacity dynamics, rate structures and other cost drivers.

Download the country overview in the highest available resolution including a description of all values:

Demand characteristics

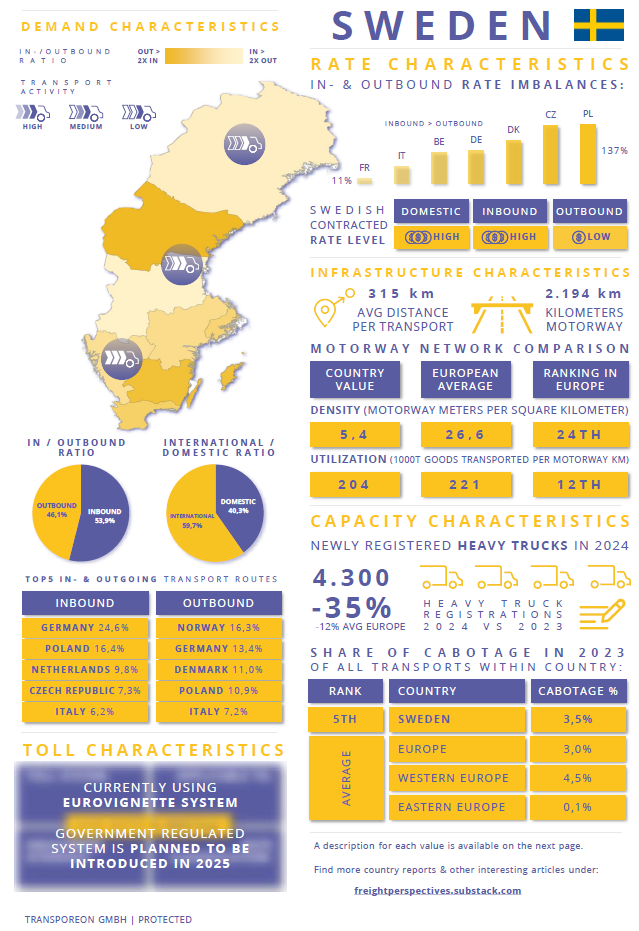

Having an advanced economy focused on high value added industries and services, Sweden imports a larger volume of goods by road than it exports. This results in the Swedish road freight market exhibiting a measurable imbalance between inbound and outbound flows. Our data suggests that inbound transports account for 53.9% of international road goods traffic, while outbound transports make up the remaining 46.1%.

Germany is Sweden's primary road freight partner, leading inbound flows (24.6%) and ranking second for outbound flows (13.4%). Poland is also a major partner, ranking second inbound (16.4%) and fourth outbound (10.9%). Other key partners include the Netherlands (inbound), the Czech Republic (inbound), Norway (leading outbound), Denmark (outbound), and Italy (5th in both lists). This distribution is a result of integration of Sweden into the broader EU economy and strong links with neighboring Nordic countries.

Concerning local demand, Swedish industry is largely concentrated in the southern and central parts of the country, especially surrounding the major cities of Stockholm, Gothenburg, and Malmö. Although northern Sweden contributes significantly through mining and forestry, the most diverse and value adding industrial activities are clustered further south.

One of the unique features of a local market is a significant utilization of road trains (longer and heavier vehicles), allowing combinations significantly exceeding standard European dimensions, with lengths up to 34.5 meters and weights up to 74 tones permitted on designated parts of the road network. A cross border movement of road trains is possible with Finland and, with some restrictions, with Norway.

Toll characteristics

Sweden is part of the Eurovignette collaboration, along with Luxembourg and the Netherlands. The Eurovignette is a mandatory periodic road user charge for heavy trucks and truck/trailer combinations.

From March 25, 2025, Sweden, along with the other Eurovignette countries, implemented a revised tariff structure incorporating CO2 emission classes alongside the existing Euro emission standards. Vehicles are now categorized into five CO2 classes, with Class 1 being the default (typically including Euro VI trucks) and Classes 2-5 representing progressively lower CO2 emissions. Vehicles in the lower CO2 classes (more efficient) benefit from reduced Eurovignette charges.

There were some reports of Sweden to consider implementing a km-based heavy truck toll in the country as early as 2025, but so far no decision was made by government or legislators, as they face considerable pressure from local industries opposing such toll systems, as they often have to rely on long-distance domestic road trips.

As an addition to the Eurovignette system, there are also congestion tolls for parts of Stockholm and Goteborg. Some newly built bridges charge usage tolls too, including Öresund Bridge connecting Sweden with Denmark, as well as the bridges in Sundsvall, Motala, and the Skuru Bridge in Stockholm

Capacity characteristics

In 2024 Swedish carriers registered 4.300 new heavy trucks, a sharp drop of -35% in comparison to 2023. This decline is much higher than the EU average of -12% for the same year marks. Continuation of this development may lead to gradual increase in average vehicle age and carry implications for maintenance costs, fuel efficiency, and environmental performance of local carriers in future. But on a bright side, Sweden is among the leaders in Europe in adoption of trucks with alternative drives, with 6.6% of new heavy truck registrations being Battery Electric Vehicles.

The local Swedish road haulage market is highly fragmented. While a few large, established logistics providers operate with significant scale and network reach, the vast majority of the market consists of numerous small and medium-sized enterprises (SMEs). This fragmentation fosters competition among carriers, which can exert downward pressure on freight rates, particularly during periods of balanced or weak demand. Smaller operators are also more likely to operate under tighter margins and possess less resilience to market shocks or sustained cost inflation. The persistent truck driver problem is another significant concern for Swedish carriers, as it creates a significant upward pressure on driver wages and limits the transport sector's ability to scale operations flexibly and rapidly in response to surges in demand.

High demand for inbound transports makes international carriers compete for cabotage transports with local players, as they grasp for opportunities to find a load on a way back from the country, allowing Sweden to have a higher than average share of cabotage and somewhat ease domestic market capacity concerns.

Infrastructure characteristics

Sweden benefits from a generally high-quality road network, characterized by good maintenance standards that facilitate efficient and reliable transport operations. Key arterial routes, including the E4 motorway running north-south along the eastern coast, the E6 motorway tracing the western coast, and the E20 route connecting major cities across the south (Stockholm, Gothenburg, Malmö and Kopenhagen (Denmark) via the Öresund Bridge), handle substantial volumes of freight traffic.

The overall density of Sweden's motorway network is 5.4 meters per square kilometer. This figure, ranking 24th in Europe, is considerably lower than the European average, reflecting Sweden's large land area and relatively dispersed population compared to many central European countries. This lower density can necessitate longer transport distances, particularly in rural and northern regions and, as a side effect, ensures considerable utilization of existing motorways, allowing Sweden to be in the middle of European rankings for this metric.

A significant portion of Sweden’s international trade, particularly for heavy goods vehicles, depends on a comprehensive network of Roll-on/Roll-off ferry services across the Baltic Sea, connecting it primarily with Germany, Poland, Denmark, Finland, and the Baltic States. Complementing the ferries is Öresund Bridge, a state of the art link across the sea between Sweden and Denmark.

Rate characteristics

Corresponding to the flow imbalance mentioned earlier in this article, the Swedish market suffers from a significant rate disparity. Inbound transport rates are on a high level and are considerably higher than outbound rates, with the data suggesting inbound rates reaching 137% of outbound rates for Poland to Sweden - the highest rate imbalance we currently observe. This is a result of higher demand for transport capacity entering Sweden compared to leaving it. Geography dictates a sole exception for this rule, as transports to Sweden from Norway are usually cheaper than the other way around.

Domestic rates for transport in Sweden are also on average higher, but they depend a lot on region and specific direction of transport, as a function of general north-south imbalance and concentration of industry in southern and central Sweden.

Traditionally, a significant part of costs of transport in Sweden came from high fuel taxes and requiring substantial biofuel blending, but from 2024, the government significantly cut both the direct fuel taxes and, more drastically, the biofuel blending mandate from 30% down to 6%, causing a noticeable drop in fuel costs. This move, aimed at consumer relief but criticized for its environmental impact, will be partially adjusted in mid-2025 with the biofuel mandate for diesel fuel increasing again to 10%.

Conclusion

Sweden's road freight sector faces significant challenges, balancing potentially moderating domestic demand amid a strong reliance on internal economic activity. Persistently high operating costs, particularly fuel and driver wages stemming from shortages, continue to pressure carrier margins, and a need for expensive investments due to technological and infrastructural shifts within a framework of green transition adds an extra financial strain.

But, counter-intuitively, Sweden's opportunity lies in continuing its proactive stance on sustainable domestic transport solutions, which may help decouple its internal market dynamics from international trends and create domestic capacity. Insulating the national sector from European capacity turbulence will in turn help widen the operational and technological gap between domestic and cross-border transport activities. Successful handling of future challenges for Sweden would require wise and sustainable adaptation of new technologies, while paying attention to costs and driver retention.

Oleksandr Kulish

Senior Consultant

Transporeon