Diversification of the Sourcing Landscape will Impact European Transportation

Will we see nearshoring or near-sourcing boost European transportation demand? Is the market prepared for additional volumes if this trend halts true?

In some of our posts and articles we have already highlighted the necessity to diversify supply chains in order to mitigate potential disruption events and factors. But what would that mean for transportation in general and for road transport in Europe in particular? In this article, I will share my view and expectations of what could potentially happen in the coming years.

In the last 4 years we saw major events like:

COVID-19 pandemic

Russia-Ukraine war

USA-China trade war

Global sanctions

Extreme weather conditions

Material shortage

Port congestion

Brexit

Attacks on critical infrastructure and shipping routes

These events challenged or even disrupted today’s highly efficient supply chains. This was a shock compared to the period between 2012 and 2020 with almost no or less pronounced events. In numerous articles, posts and white papers, industry experts as well as supply chain professionals highlighted that Shippers are about to, or already adapted to this new situation. Some of the most prominent measures are discussed and described below.

Potential relocation measures

As these measures aim to shift production or sourcing locations. We need to expect that reshoring, nearshoring and near-sourcing will directly impact European transportation and consequently increase the demand of transportation services. Reuters Events in partnership with Maersk published a supply chain white paper in 2023. This paper includes results of a survey among 368 supply chain professionals, who indicated below listed countries as their preferred relocation sites. It shows that the biggest relocation potential lies within Asia, but also Germany and Poland within Europe are ranked amongst the first places.

Source: Reuters Events Supply Chain white paper in partnership with Maersk - A generational shift in sourcing strategy

The necessity of changes to the current sourcing principles and existing supply chains started after the Covid pandemic. Now, two years later, the question arises, if there is a shifting effect already visible within Transporeon transportation data?

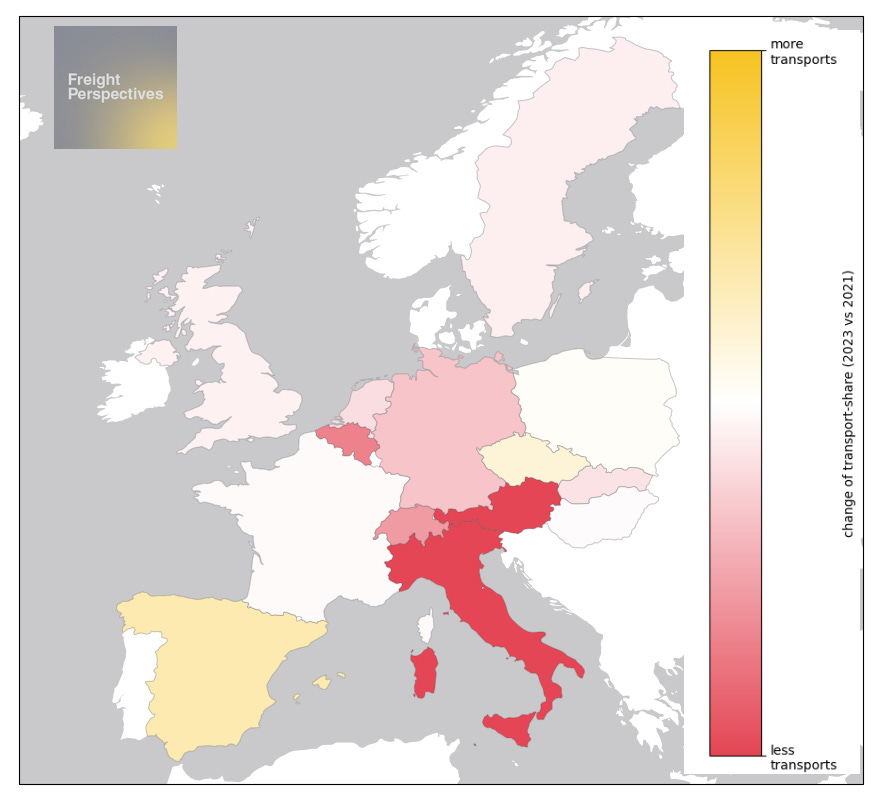

For this reason, we’ve analyzed how German imports are distributed among different countries and how this distribution changed between 2021 and 2023. For instance, Austria's contribution to the overall German imports decreased by 10% in 2023 when compared to 2021. The below map shows the change in shares of imports into Germany.

Change of transport share for inbound Germany

Source: Transporeon Transport Execution data

Decreases in overall amount of shipments are obvious and the map illustrates the general economic downturn in 2023. Trades sustaining this overall trend are Spain (+1,8%), Czechia (+0,9%) to Germany whose volumes grew against the trend. In contrast, flows from Italy (-16%), Austria (-9,8%) and Belgium (-3,4%) showed significant reductions.

How does this fit to an expected nearshoring or near-sourcing effect? Shouldn’t we be able to see more increases underpinning the described effect?

Well, not necessarily as changing high efficient supply chains takes time. New suppliers, plants and capacity needs to be found or created. Assuming the decision to shift has been made in 2021, then we can’t expect that they are visible now. Such strategic decisions aim on time horizons of up to 5 years, so two years are most likely too early to observe this effect based on transportation figures. Additionally, the current economic challenges could also delay the decisions or its implementation.

If we assume, on the other hand, that such a gradual shift towards Europe exists, we need to prepare for demand increases. Currently, European transportation demand is down by around 3-5% compared to a normal level. Flattening Inflation rates combined with wage increases will likely raise consumption moderately and thus elevate demand for transportation towards the level of 2021 by the end of 2024. First additional flows serving from the still theoretical relocation shift cater for a further increase potential.

If this hypothesis proves true, we have a significant risk of entering into a period of capacity shortages. This is particularly true, if the theory of observed fleet reduction I described in my last articles halts. A significant increase in transportation rates would be the logical consequence

Help us to evaluate!

Many thanks for your contribution!

Christian Dolderer

Lead Research Analyst