Heavy Truck Registrations Continued to Drop in Q1 2025

Market Monday - Week 22 - Q1 registration figures confirm ongoing market downturn with one surprising exception

Heavy truck registrations fell sharply in 2024. We eagerly awaited the Q1 2025 figures to evaluate the future trends, as these registrations serve as a crucial indicator of available transport capacity and the mid-term market direction. Two key questions emerged: Would the downturn continue or intensify? And would 2025`s figures fall significantly below 2024´s levels? The answers are vital for understanding both our industry´s current state and future trajectory.

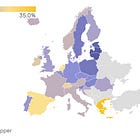

The following map illustrates how heavy truck registrations changed from Q1 2024 to Q1 2025, revealing steep declines across most of Europe.

Hover or click the map to review and explore country-specific values

Most European nations saw registrations drop by more than 10% compared to the same period last year, with Greece, Switzerland, the Netherlands, Germany, Croatia and Slovakia showing the steepest declines - all below -20%. However, only Lithuania, though smaller but significant in the European fleet landscape, opposed this trend with remarkably high registration increases. Like the Gallic village in the Asterix comics, it stood alone against the prevailing trend. While Q1 2024 registrations were relatively low in Lithuania, Q1 2025 represents in addition an almost record high absolute value for Lithuania.

Electric heavy truck registrations opposed the diesel truck trend. In Q1 their share increased from 1,1% to 1,6% compared to the previous year.

What are the industry and market implications?

In February I shared my thoughts on the registration trend.

Although Q4 2024 values were higher than expected, a persistent downward trend was anticipated. The Q1’25 data is offering no signs of bottoming out or reverting to growth. While Q2 might show higher registrations compared to Q1, I strongly expect year-on-year figures to fall short of previous years’ high levels. If so, the 12-month moving average of registrations will continue its decline.

While reliable de-registration figures are not available, our fleet model suggests that end-of-life trucks currently exceed new additions, assuming typical vehicles lifecycles. This factor, combined with cautious investment spending, points to ongoing constraints in fleet availability and market capacity.

Without any changes in demand dynamics, these market dynamics paint a clear picture for 2025: The combination of reduced fleet registrations, persistent driver shortages, and news of fleet reductions signals a fundamental shift. Therefore, we need to anticipate continued capacity constraints and substantial high spot price levels, particularly in Western Europe to continue during peak times around the public holidays. Forward-thinking shippers should prepare for this market sentiment by securing capacity early and developing robust contingency plans.

Christian Dolderer

Lead Research Analyst

Trimble Transportation (Transporeon)