Heavy Truck Registrations in Europe react to Challenging Economic Landscape

Why High Truck Registration Figures don't Guarantee Fleet Increase

3 months ago, I shared my analysis and perspective on the near-record-high registration figures for heavy trucks across Europe in 2023.

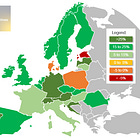

Now, the latest Q1 statistics paint a different picture. The era of consistent increase in registration figures halted, signaling a potential trend in change. The following map shows the change in registrations from Q1 2023 to Q1 2024. A decrease in registrations is clear, with a geographical pattern highlighting Central and Eastern European countries experiencing the most significant drops.

New heavy truck registrations Q1 2024 vs. Q1 2023

Source: ACEA, own illustration

Only Belgium, Croatia and Ireland continued the upward trend with significant registration increases. In contrast, Baltic countries, Poland, Sweden, Czechia and Slovakia show large decreases, suggesting carriers are limiting fleet modernization due to their changed financial situation.

The chart below shows that European registrations reached their peak in Q2 2023. Given the near-record-high new registrations of heavy trucks in 2023, a technical decrease seems logical. Although latest values suggest an increase compared to Q4 2023, they reveal a 6,6% decline compared to the same quarter of the previous year. This marks the second drop year-over-year, indicating this trend change.

Heavy truck registrations in the past 5 years

Source: ACEA, own illustration

In my previous article, I identified two main reasons for the remarkably high registrations in 2023.

A time shift between investment decision and market entry.

An increase in registrations before significant regulatory or technological changes, as seen in the past.

The first point`s relevance seems to be gradually diminishing. The backlog of new truck orders is nearly processed, with truck manufacturers like Daimler Truck stating that 2023 was an exceptionally good year. However, they expect a return to normal demand this year. The second point likely still impacts, keeping registration figures relatively high compared to other years with a comparable economic situation. Note that Q1 2024 registration figures are still above most other Q1s in the past five years.

For the coming quarters we can expect further drops in HCV registrations, especially for diesel engine trucks. Alternative engine registrations may further increase, but their current overall share remains limited - battery electric vehicles (BEV) accounted for only 1.1% of total registrations in Q1 2024.

Summary

The high overall registrations in 2023 and still elevated Q1 2024 figures don't necessarily indicate a proportional increase in the available fleet. Given the driver shortage and the overall economic situation, we are likely seeing fleet modernization rather than enlargement. Reliable de-registration figures are not available and some press releases mention fleet decreases also due to driver shortages. For this reason we even can’t rule out a decrease in the available fleet. This scenario would be underpinned by increasing rejections as monitored and described in this article.

Despite Q1`s figures, we can still expect registrations of electrified trucks to rise rapidly, as new models enter the market in 2024. More shippers will conclude their research on potential areas for e-truck implementation and begin pilot operations.

These high registrations won’t prevent the market from demand fluctuations. If demand picks up again, we will likely see capacity shortages and high spot rates.

Christian Dolderer

Lead Research Analyst