Seasonal Trends or Fundamental Shift? Analyzing the Recent Surge in European Spot Rates

Market Monday - Week 37: Road Spot Prices React to Post-Summer Demand Increase

Seasonal fluctuations are a major reason why spot prices in the logistics sector are highly volatile. Many of my previous posts have focused on this dynamic. Today, I delve deeper into the current effects we are experiencing in the spot market.

In the past two weeks, many countries and corridors have shown a sharp increase in their spot rates. Increases of over 20% compared to four weeks ago are not exceptions; they are the reality. While domestic markets are usually more stable regarding price movements than international markets, we are also seeing significant increases domestically.

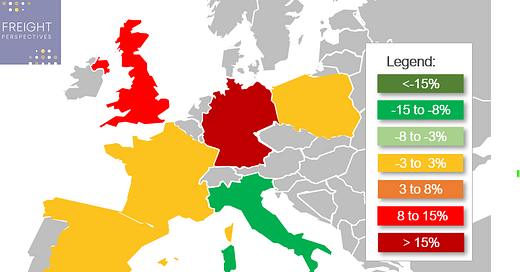

The following map highlights the main European countries with their latest spot price developments. Notably, Germany is in the spotlight with increases around 20% compared to week 32.

Spot Market Evolution: Prices from Week 32 to Week 36 in 2024

Source: Transporeon Market Insights, own illustration and evaluation

For more information and answers why Italy acts completely different, please see our post from week 35.

The UK also demonstrates high increases, raising questions about whether we are witnessing a fundamental change in transport prices for these countries or for Europe as a whole?

To understand whether we are seeing a fundamental change or a usual seasonal fluctuation, a more detailed look into different markets and the reasons behind these movements is needed. I compared this year's developments with the same period last year. The results, visible in the following table, highlight that many movements, or more precisely the direction of the movements, follow seasonal patterns.

Comparison of Spot Prices from Week 32 to Week 36 in 2023 and 2024

Source: Transporeon Market Insights, own illustration and evaluation

In my view, we clearly see a seasonal movement. However, the magnitude of changes in some markets is remarkable. Spot rates are already higher in 2024 compared to 2023. If we now see considerably higher percentage changes, like in Germany, Poland, and Hungary, it may indicate other influencing factors. Higher demand for transportation or a lack of available capacity are the next logical reasons.

Unfortunately, it’s still too early to determine if this is based on a fundamental change or a usual short-term occurrence. If we look at international markets, the picture becomes clearer, pointing towards usual seasonal increases as the reason for the current spot price hikes. The next table contains four exemplary corridors for illustration.

Comparison of Spot Prices from Week 32 to Week 36 in 2023 and 2024

Source: Transporeon Market Insights, own illustration and evaluation

Key Takeaways

The current spike in spot market prices can largely be attributed to the seasonal upswing following the summer slowdown. With many companies resuming operations after plant closures or reduced production, the short-term need for transport solutions is high. On the carrier side, many trucks are returning to service after maintenance downtimes or drivers’ vacations. During the ramp-up of pre-summer networks, a short-term squeeze of capacity and demand excesses is expected until usual efficiency is achieved again.

However, there are hints of additional factors at play. While it's too early to draw definitive conclusions, the coming weeks leading up to October will be crucial. They'll provide valuable insights into whether we're experiencing an accelerated seasonal increase or if more fundamental changes are underway in the transport market landscape.

Christian Dolderer

Lead Research Analyst